INTERVIEW: Every Hour Spent Chasing a Payment Is Lost Revenue

Let’s be real: getting paid on time in Nigeria can feel like a full-time job all on its own We sat down with Akin Olunloye, Product Lead of PaywithAccount at OnePipe, to talk about Nigeria’s payment culture problem—and how a bit of structure can go a long way in turning that around.

A Conversation with Akin Olunloye, Product Lead at PaywithAccount

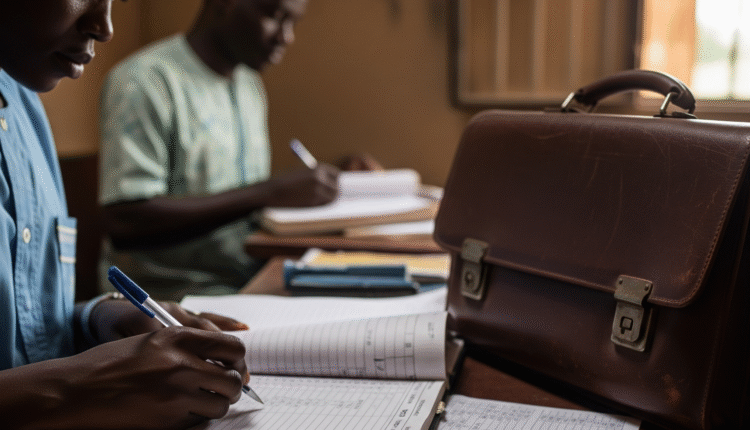

From school admins and salon owners to cooperative treasurers and delivery riders, many Nigerian business owners are stuck in the same frustrating loop—doing the work, delivering value, then waiting endlessly to be paid.

It’s not just annoying—it’s stressful, costly, and downright draining. And with the economy throwing curveballs left and right (hello, fuel prices and inflation), delayed payments can knock a small business off balance fast.

We sat down with Akin Olunloye, Product Lead of PaywithAccount at OnePipe, to talk about Nigeria’s payment culture problem—and how a bit of structure can go a long way in turning that around.

Q: Why are late payments such a big issue in Nigeria?

Akin: Honestly, a lot of it comes down to how we do business here—lots of informal arrangements, verbal commitments, and good ol’ trust. Which is beautiful in some ways, but also… chaotic.

People often see paying you as optional—or something they’ll “get to eventually.” Meanwhile, you’ve already spent money on fuel, supplies, salaries… and now you’re stuck waiting. That waiting creates a vicious cycle: business slows down, cash flow dries up, and everyone’s just firefighting.

Q: And the follow-ups take a real toll, right?

Akin: 100%. Every hour you're calling, texting, or WhatsApping a customer about payment is an hour you’re not working on your business. It wears you out.

We’ve seen school owners dipping into personal savings just to pay teachers because parents haven’t paid fees. We’ve seen artisans turning down new gigs because old clients still owe them. That’s real money and energy going to waste—and it builds resentment too.

Q: So it’s not a new problem, but it’s getting worse?

Akin: Exactly. Delayed payments have always been around, but now the economic pressure is heavier. A small delay can ripple through a business—supplier doesn’t get paid, staff gets delayed, the whole thing slows down.

Plus, expectations have changed. People want things fast, but we’re still using outdated systems to collect money. It creates a mismatch that just doesn’t work anymore.

Q: How does PaywithAccount help?

Akin: Think of PaywithAccount like a friendly payment autopilot. It lets businesses or cooperatives set up a direct debit mandate, where customers give permission for you to collect recurring payments straight from their account—no reminders, no chasing.

It’s like a standing order, but much simpler and more tailored for Nigerian businesses. No complicated bank drama, no custom tech setups. Just smooth, structured collections.

Q: And how’s the adoption so far?

Akin: Honestly? It’s been amazing. We’ve seen cooperatives that used to beg for dues every month now collecting 90% of them on time. Caterers are setting up milestone payments with clients. Gym owners, schools—you name it.

What’s even better is the feedback: people feel respected. Customers know what’s coming and when. Treasurers aren’t stressed. Everyone wins.

And business owners suddenly have time again—time to think, plan, build. That’s huge.

Q: Some folks might be wary—thinking mandates feel risky or intrusive. How do you reassure them?

Akin: That’s a valid concern, and we totally get it. But here’s the thing: every mandate is 100% authorized by the customer. It’s clear, revocable, and transparent.

We don’t do sneaky stuff. The idea is to create mutual peace of mind—not trap anyone. And once people use it, they love it. No more awkward payment chasers. Everyone knows what’s expected, and when.

Q: Why do you think it’s catching on now?

Akin: Because people are tired. Hustling non-stop is exhausting, especially when you’re constantly cash-strapped because someone hasn’t paid.

Nigerians want structure. They want tools that help them look and act like the professionals they are. PaywithAccount gives them that. It helps you say: “I’m not just hustling—I’m building something real.”

And trust me, your clients feel that shift too.

Q: You mentioned cooperatives. Why is this tool especially helpful for them?

Akin: Cooperatives are a lifeline in Nigeria. They help people save, access loans, and support their families. But a lot of them are still running on WhatsApp groups and handwritten ledgers.

We’ve worked with treasurers who use personal accounts and physical notebooks to track payments. That system breaks fast. With PaywithAccount, they can collect dues automatically, get real-time notifications, and operate more like micro-finance outfits—but without losing the community vibe.

It’s about formalizing without losing the soul. That’s super important.

Q: What do you hope this changes about business culture in Nigeria?

Akin: I’d love to see us stop treating late payments like they’re normal. They’re not. They’re risky, stressful, and they kill momentum.

I want more small businesses to feel like they’re allowed to be structured. You don’t have to wait till you’re “big” to behave professionally. Tools like PaywithAccount help you grow with dignity, consistency, and less chaos.

If we all start expecting timely payments—and making it easy for people to pay—then we’re building a healthier, more sustainable business environment from the ground up.

Q: Final word—what would you say to a small business owner who’s unsure about trying this?

Akin: Just try it with one customer. Seriously—pick someone you trust and set up a simple mandate. You’ll see how much smoother it feels.

You deserve to be paid on time. You work hard, and structure shouldn’t be a luxury. It should be part of how we do business—whether you’re running a big company or a small outfit.

Start small. Set up systems. That’s how businesses grow.

See how PaywithAccount can help your business